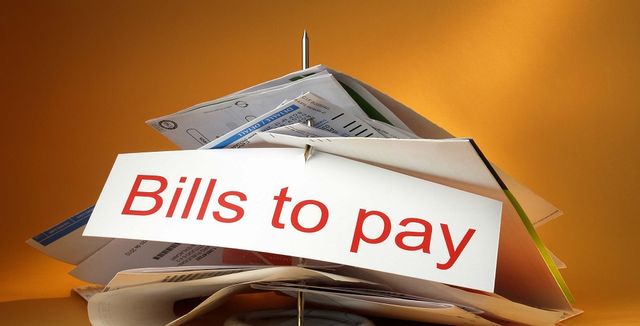

Financial De-Clutter!

Facing Our Finances by Sharon Bailey

One of the top causes of stress is finances. Why not apply some "spring cleaning" to this area of your life? Many people are bogged down in debt, loans, and bills. It can get extremely overwhelming. Get in front of your finances right now!

The first thing you have to do, as scary as it seems, is come face to face with your finances. If you are scratching your head right now wondering what I'm talking about, good for you because that means you know exactly what is going on in your finances. Many people don't. Many people are so behind and overwhelmed, they don't even know what or who they owe.

Wherever you are in your financial journey, you're in luck. Below are some steps you can take to eliminate some financial clutter.

While I'm not a certified financial advisor, I have been through my own journey of financial messes, mishaps, bad investments/advice, etc. If you need help, I'd be happy to sit with you, review your situation, and offer what I can to get you organized and less stressed! It would be completely confidential and it's free. I am in the best financial shape of my life and I want to help others get there as well. Email me to set up an appointment @ [email protected]

Financial De-Clutter Steps.....

1. Make two lists:

Household expenses: These will include mortgage/rent, utilities, property taxes, food, gas. These are the expenses that are required to be met monthly.

Extras and current balances: credit cards (list all cards separately, not one lump sum), student loans, car loans, medical bills, take out/dining, miscellaneous debt

2. Make your budget and stick to it

Based on the above information, create a budget you can live with. Do not make this so strict that you will feel like there is no wiggle room at all. It's important to be comfortable and at ease.

All at Once!

3. Pay your bills monthly all at one time.

It seems easier to have bill due dates spread throughout the month so it doesn't seem like there is nothing left after your paycheck. If you are able to pay all your bills once a month, think of all the free time you'll have in your brain not thinking about what bill has to be paid each week.

4. Create an emergency fund

Add "emergency fund" to your extras list above and pay it a small amount with every paycheck

5. PAY OFF THE DEBT!

A very common belief is that we are supposed to be in debt. Do you know there are people that save up for their first homes and pay cash for them? Imagine not having that monthly payment. As a matter of fact take that a step further and add up all of your minimum payments for the list of debts from step #1. Take that number and imagine that all of that goes right into savings. WHAT?! Yes, it is possible.

A Little Here, A Little There...

6. Save!

Find ways to save money everywhere. Curb your spending.

Eliminate credit cards with annual fees (keeping in mind that the ultimate goal is to eliminate credit cards period!).

Consolidate or snowball your debt.

Take a serious look at your expenditures. What do you really need? What can you do without?

Make calls to insurance companies and service providers and find out what you can do to save on your bill. Even if it's $5, it's still $5.

Research!

7. Research

Take the time to research things for yourself. I had a financial advisor who once told me that I want to hold onto my mortgage to get the tax credit every year. Really? If you do the math of how much interest (which is money given away by the way) would be paid vs how much the government feels like crediting me on a yearly basis, it just didn't add up in my favor.

8. What is your net-worth?

Don't know? By knowing your net-worth month to month, you will have a full picture of exactly what your assets and liabilities are.

9. Make your money work

Do your research on this. Is a 401k plan offered to you? If so, how much is the match? If no match, perhaps a Roth IRA would be a better idea for you. Banks are offering an average of 1% APR on savings and money market accounts. How can you make your money work better for you?

10. Be a role model for those learning from you

Think of the positive impact you will have on those around you such as your kids or other family members. Taking control of your money sets the best example to those you love who are in fact learning from you. It also eliminates a level of stress increasing your overall wellbeing.